Section 6: The Sharpe Ratio

Portfolio Theory describes an ‘optimal curve’ of expected return vs. risk, which encompasses all efficient portfolios. The easiest way to define ‘risk’ is to use the standard deviation of past returns, which tells us how volatile a particular investment has been over its lifespan. Given the choice between two investments of equal expected return, an investor would obviously opt for the less risky choice and would consider a more volatile option only if there were greater expected returns associated with it.

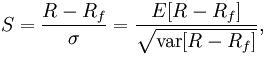

A simple way to measure risk adjusted return is by using the Sharpe Ratio, which describes the ratio of the difference between the expected return (R) and minus the risk-free return (Rf) to the standard deviation (o) of the investment:

The risk-free rate varies from year, but consider an example where it is about 3.5%. The long-term return of the S&P 500 is about 10%, with a standard deviation of 16%. This gives the S&P 500 a Sharpe Ratio of (10%-3.5% / 16%) of 0.406.

If a handicapper plays 700 games a year (about 2 per day) at a modest 54.0% expected win rate (at -110 odds), his expected return would be 36.8% of bankroll with flat betting of 1.7% of his initial bankroll per bet for the entire year (1.7% is determined using ½ Kelly at 54% expected win rate), and the expected profit would be even higher if the bankroll were adjusted each week (i.e. Kelly betting). The standard deviation of 700 bets risking 1.7% of initial bankroll per bet with a 54% expected win rate is 20.4%. Thus, a true 54% handicapper playing 700 games a year while wagering 1.7% of his initial bankroll at -110 odds has a Sharpe Ratio of (36.78%-3.5%) / 20.38%, which is 1.633. Thus, not only does investing in a long term 54% handicapper have an expected return nearly four times higher than the S&P 500, it also has a much more attractive Sharpe Ratio.

An investor can reduce the risk of their overall portfolio by holding investments which are not positively correlated with other investments. As the economic crash in 2008 demonstrated, even an investor who has dutifully diversified themselves between different kinds of stocks and real estate found themselves completely exposed when the market tanked in almost all areas. The advantage of sports betting is that it is completely removed from any other market. It’s the very definition of zero correlation and is a fantastic way to diversify any portfolio.

Factoring sports betting into portfolio optimization is a complex task because one must factor in other opportunities and then adjust for risk tolerance. However, given that both the annual return and risk adjusted return (Sharpe Ratio) of my investments are well above those of the S&P 500, it’s safe to say that my picks would be a valuable investment for you. I would recommend allocating between 5% and 15% of your annual investing budget to sports betting.