Section 5: The Dangers of Over-betting and Over-Estimating your Edge

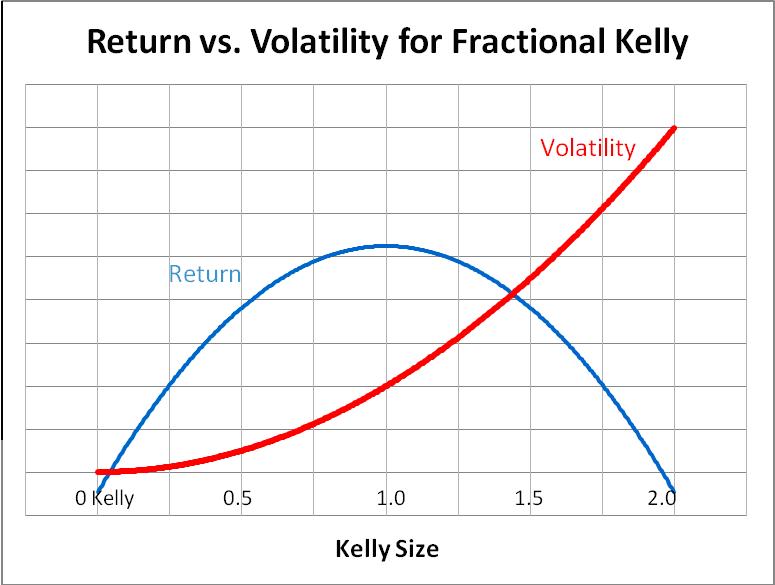

These graphs illustrate the long-term power of using Kelly sizing to increase one’s bankroll over time, and beg the question, ‘if Kelly betting will lead to such incredible returns, then betting double or triple Kelly must lead to even higher returns!’ Referred to as ‘over betting,’ this misguided notion is one of the reasons that so many +EV sports bettors go broke just like their square compatriots. It turns out that someone betting 1.5 Kelly has the same expected growth as someone betting 0.5 Kelly, but with tremendously wilder upswings and downswings, and much more risk. Betting 2 Kelly has the same expected return as not betting at all: exactly zero, and betting more than two Kelly has a negative long term expected growth even if you are making positive expected value bets, and your bankroll will eventually fall to zero! In conclusion, Kelly sizing is in fact, as has been stated several times, the point at which return is exactly optimal.

Another important point to consider is that the dangers of over-estimating and over-betting your edge are not restricted to Kelly Betting. Flat bettors or even bettors who gamble ‘however much they feel like’ on a given trip to the casino frequently over-estimate and over-bet as well. Generally, bettors this unsophisticated are over-betting no matter what they do; they have zero edge at best, and probably a negative edge expectation, and shouldn’t even be betting in the first place. Yet, many advantageous cappers or bettors who buy my picks can unwittingly over-bet as well.

In addition to the dangers of over betting, the Kelly Criterion also has large swings compared to flat betting. For example, a given positive expectation wager that compounds at 10% per time unit will eventually double, and of course grow to infinity. However, since the swings with Kelly betting are so large, the initial bankroll actually has a 1/3 chance of being cut to half its initial value at some point before doubling. To an academic, this is immaterial since they can keep their eyes on the long run expected growth. However, to investors who are often investing money for a shorter period of time and expecting immediate and consistent returns, this relatively high short-term risk and volatility is unacceptable.

However, because variance is exponentially related to return, we find that cutting the bet size in half causes only a nominal reduction in expected growth, but square roots the variance. In other words, if we were to bet one half Kelly unit on our 10% per time unit (with full Kelly) proposition, we would grow our funds at a slightly slower rate of 7.5% per time unit while our risk/variance/volatility would be the square root of what it was previously. To use the previous example, we would now fall to 50% of our starting bankroll only 1/9 (rather than 1/3) of the time before doubling it – a much more tolerable level of risk for the average investor.

Betting one half Kelly unit instead of a full unit also helps prevent accidental over betting when we may have overestimated our edge, and we have already examined how destructive this can be. For example, if a bettor estimates his win percentage to be 58%, he would accordingly bet 11.8% (at 10:11) of his bankroll following full Kelly sizing. But suppose that despite correctly picking a winner, the bettor had incorrectly assessed the real win percentage, and the side he picked would in fact be a winner only 55%, rather than 58% of the time. In this case, he should have bet only 5.5% of his bankroll, and since he overestimated his edge by 3% he actually over bet and wagered more than 2.1 Kelly. This will result in a negative expected growth despite the fact that the bet was still positive expected value and would win 55% of the time. However, if the bettor instead followed a policy of betting ½ Kelly, overestimating win percentages is not nearly so dangerous. In this case, the win percentage miscalculation would have caused him to mistakenly bet twice the determined appropriate bet size… and he would have bet 1.0 Kelly instead of ½ Kelly, causing himself no harm whatsoever.

Full Kelly wagering is optimal when you know the odds exactly (as might a card counter who is aware of precisely which cards remain) but is too dangerous when positive expectation wagers are less certain. Dr. Bob still strives to estimate his win probabilities exactly, but even so, some degree of uncertainty exists. Bettors are well advised to halve or even third their bet sizes to cut down immensely on volatility while sacrificing relatively little expected growth.

Talk to any career bookie, and you will find a shocking truth: many (maybe even as high as 20% or 30%) sports bettors win over 50% of their games in the long run. However, their concepts of money management are so poor that almost all of them over bet wildly, driving their long-term expectation to zero, and they all end up completely broke. The following anecdote, which could be any one of a million different bettors, illustrates the dangers of over betting:

“This guy Archie came into my book on the first week of September and bet about $1k on ten different NFL games. He ended up going 9-1 and turned his $10k into $18k (we are ignoring vig for the sake of simple calculations). I knew he would be back though, and sure enough he was there the following week, betting $2k on nine different NFL games and totals. He got hot again, and went 7-2, and his $10k had now grown to $28k in just two weeks. I wasn’t worried though, because the story is always the same with these guys. In week three, he came in with 7 more ‘locks’ and put $4k on each game, only to go 1-6, losing three of the games in the last minute. Frustrated with his bad luck, he put all of his remaining $8k on the Monday Night Under, which busted when the Broncos scored a meaningless touchdown in the final minute. Three weeks after he started, Archie was broke.”

Archie is a prototypical gambler with absolutely no investment discipline. He started out with $10k, went 17-10 (63%) and ended up broke. Rampant over betting is a great way to empty your pockets while winning two thirds of your games. If Archie had just flat bet $500 per game the whole way through, he would’ve turned his $10k into $13.5k in three weeks. If he had bet 5% of his bankroll on each sequential game, he would have run his $10k up to $18.7k, and then slid in week 3 to finish at $13.7k, netting a $3.7k profit, albeit with some big swings. Does this story sound familiar? It should – it describes about 90% of the gamblers you’ll find at any given time in a Las Vegas sportsbook. Dr. Bob’s customers are different, though, which is why books are so scared of them. They bet on winners, and they bet with disciplined financial intelligence designed to extract a profit in the long run.